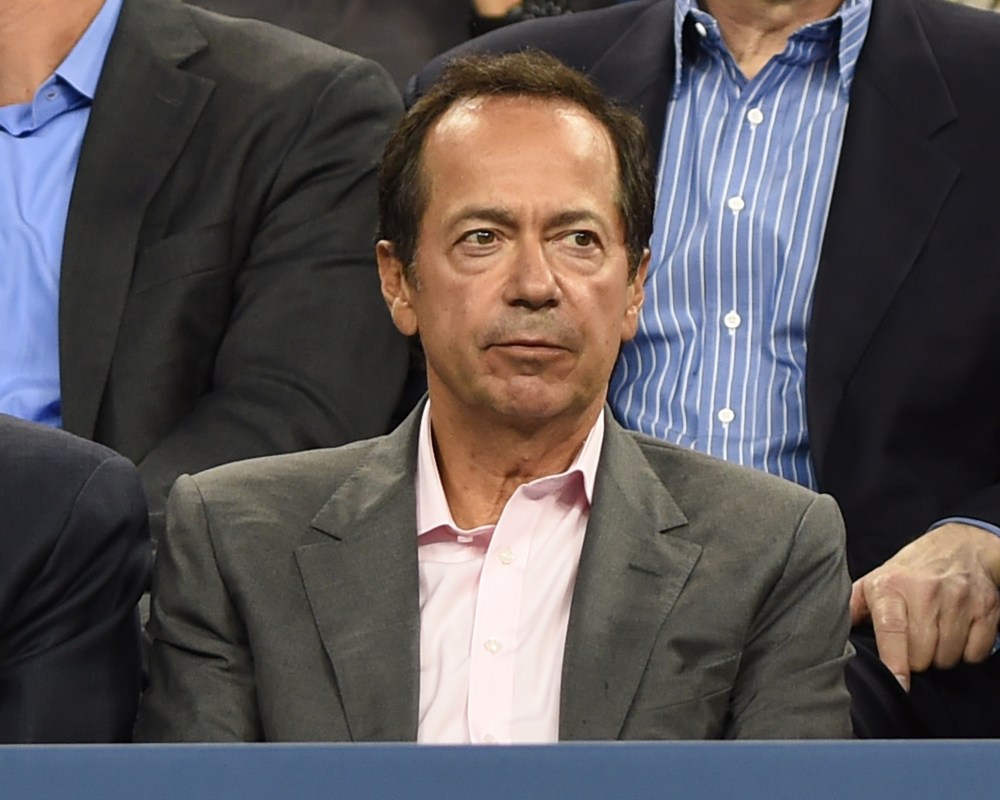

John Paulson made a once-in-a-lifetime bet before the financial crisis, ending up with $4 billion. Now, the IRS wants it back. By April 17, the hedge-fund manager must make federal and state tax payments of about $1 billion, reports The Wall Street Journal.

This is on top of roughly $500 million in taxes he paid late last year. This sum dwarfs the maximum amount the Internal Revenue Service will allow any single taxpayer to pay with a single check (that amount it $99,999,999). According to WSJ, Paulson took a chance and bet big against subprime mortgages ahead of last decade’s financial crisis. He personally got $4 billion, but he also earned about $15 billion of profits for his funds. He deferred the bulk of those taxes on these profits by using a tax provision available at the time to hedge-fund managers.

But now, he has to pay up. Though he is in no way short on cash, Paulson isn’t doing as well as before. After a string of poor results, a bad bet on pharmaceutical stocks and client defections, Paulson has had to sell various investments to cover the bill. He also started cutting staff members at his firm and fired senior traders. WSJ reports that Paulson was managing $38 billion seven years ago. But now, Paulson & Co. is managing under $9 billion, and most of that is Paulson’s own assets.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.