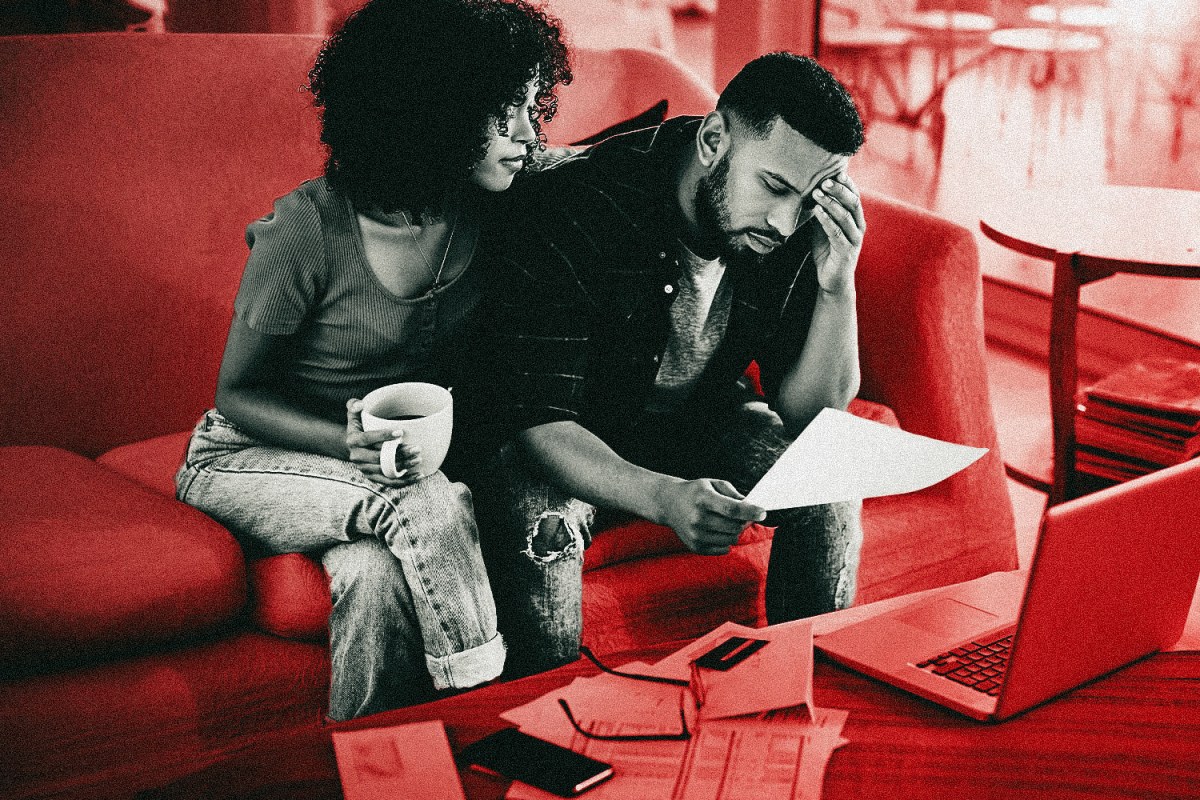

One of the most sinister yet oft-ignored forms of relationship dishonesty comes in the form of financial infidelity. Haven’t heard of it? That’s okay. We’re going to break it down for you, because the more aware we become of our seemingly harmless financial habits and behaviors — or those of our partner(s) — the better equipped we’ll be to handle the tumultuous circumstances they can create in relationships.

When you think of stepping out on your partner — cheating, having an affair — what comes to mind? Sex. Sexual infidelity is essentially synonymous with the word “infidelity.” “Cheating” is similarly thought of mainly in sexual terms.

However, breaking trust in a relationship can go far beyond sexual affairs. Stepping out on a partner is not just about sleeping with someone else without their knowledge. Infidelity means hiding important secrets of all kinds about your life from your partner in ways that can negatively impact them as well as the relationship.

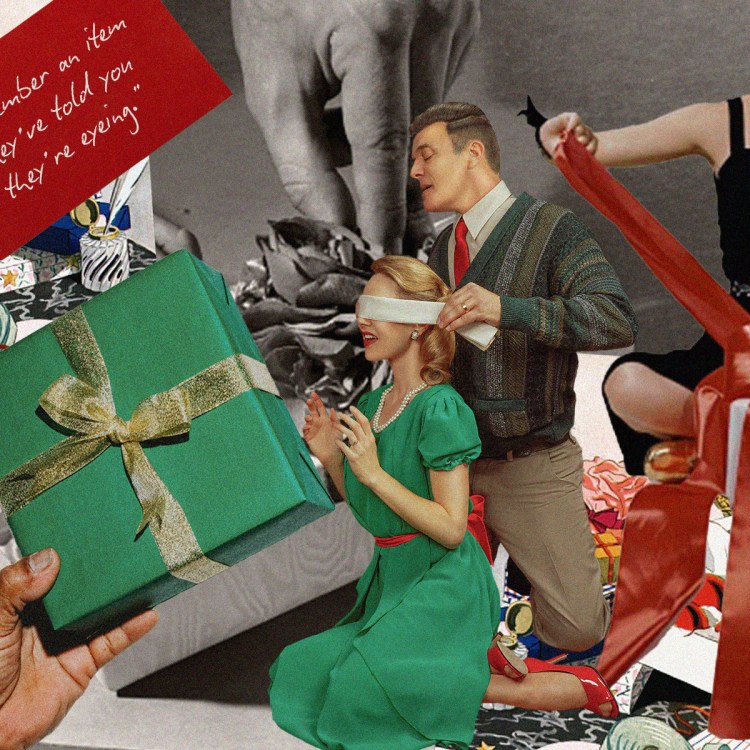

While lying about your financial situation isn’t directly linked to sex, the seemingly sexual connotations the phrase “financial infidelity” conjures aren’t entirely ill-fitting. After all, both money and sex are touchy subjects, ones that are still often considered taboo in many social contexts.

“Just like sex, we very rarely talk about [money] frankly and honestly, or are encouraged to manage it wisely,” says Lucy Rowett, a certified sex coach and clinical sexologist, adding that the lack of sex education in our society parallels a similar deficiency in comprehensive financial schooling. “We receive very little good financial education, or see it represented positively in the media.”

Unfortunately, money — like sex — is a major part of life and relationships, and being able to talk about it openly and honestly with romantic partners is key to maintaining a healthy relationship and healthy finances. Whether it’s sex or money, trust is everything when it comes to healthy long-term partnerships — monogamous, poly or otherwise.

What exactly is financial infidelity?

In simple terms, it’s when you lie to your partner about money. “In a relationship or partnership, financial infidelity is when one person violates an agreement related to the management, acquisition, allocation or care for their finances,” explains Jennifer Litner, MFT, a sex therapist, sexologist and founder of Embrace Sexual Wellness.

This can range from hiding your credit card debt or opening a secret credit card to having a secret bank account no one knows about, hiding a compulsive shopping habit or even completely wiping out your personal (or joint) bank account. This is not an exhaustive list, of course, but it gives you a glimpse into the often incredibly corrosive ways financial issues can weave their way into relationships.

Naturally, if you come to learn that your entire financial security has been compromised by someone who you’ve chosen to spend your life with, it can turn your world upside down. “There is a feeling of betrayal and mistrust when one partner refuses to talk about certain financial decisions. This leaves their partner feeling unsafe, unsupported and vulnerable,” says certified money coach and president of Summit Financial Management, Carrie Casden.

Why do people commit financial infidelity?

There are many reasons why people hide their financial shortcomings from a partner. Mostly, it comes out of a toxic culture that looks down upon poor financial choices. There is so much shame associated with money loss and debt that we hide in order to avoid facing it.

In partnerships, we fear looking weak, irresponsible or like we’ve failed. According to Casden, someone who finds themselves practicing financial infidelity has “not learned the tools to effectively communicate their shortcomings when it comes to financial decisions, and rather than being honest and feeling like they are in a supportive, non-judgmental relationship, they take the path of avoidance and secrecy.”

At some point, you may find yourself in such a massive financial hole that you feel like you’re drowning. This can be a breaking point for some people — and some relationships.

What to do when financial strain causes relationship rupture

1. Figure out how you got here and take responsibility

The first step is taking ownership of your situation and being honest with your partner. This may sound daunting — and that’s because it really is. “Think about why you have been hiding this, what is the emotional root of this behavior,” says Rowett. There are many reasons we hide issues around money, gambling and spending from our partners, but getting a better understanding of what made you fall into those patterns can help you feel more prepared to open up to your partner.

2. Get outside help

A mistake many couples make is clinging to the idea that this is “just a part of life” and they should “go it alone” and handle their own money issues. But the truth is, most people struggle with money and it is often a source of strain for both individuals and relationships. “You may need guidance or advice from a clean slate who is outside the line of stress. Do everything you can to nourish and nurture yourself so that you have more to give to your partner, children and family,” says Dr. Fran Walfish, a psychotherapist and author of The Self-Aware Parent.

3. Kindness and empathy are key to survival

If you decide to end your relationship, that is your choice to make. But, if you choose to rebuild, both partners must engage together with kindness and empathy. Rarely are these problems created from a place of malice or with the intention to hurt. Usually, they come from a place of desperation. “Create an open discussion,” Walfish says. “Talking is the glue that holds relationships together.”

Yes, things may feel really horrible right now. This was a huge breach of trust with potential long-term consequences. The question is: Are you both willing to do the work to get through this together?

4. Create monthly financial meetings to show your commitment to change

You can’t just have one conversation (or even a few) and then call it a day. Rebuilding trust means bringing your partner into the fold, cards on the table. “Sitting down to jointly review credit reports, any open accounts, bank statements, credit card statements and any other financial documents will show that both people are committed to having an honest and open discussion about money,” Casden says.

“Remember that you do not have to share each and every transaction with your partner; [these coping tools are] for when you realize that you have been hiding things from them,” or vice versa. You’re not obligated to disclose absolutely every single purchase you make, but to bring your partner in on the secretive side of that spending. “Money is not an easy topic for anyone,” says Rowett. But, “by taking action, you are setting yourself up for a more secure future, both financially and romantically.”

Whether you’re looking to get into shape, or just get out of a funk, The Charge has got you covered. Sign up for our new wellness newsletter today.